how to lower property taxes in georgia

In most counties taxes for schools are the largest source of property taxes. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

. Georgia Property Tax Relief Inc. File Your Property Tax Appeal. States provide a way for citizens to lower their property taxes and this is known as a property tax exemptionSome states have low property tax but you should look for possible tax relief despite the amount.

Up to 25 cash back If the tax rate is 1 David and Patricia will owe 2000 in property tax. County Property Tax Facts. We lower the property tax burden for parcels all across Georgia and the Atlanta.

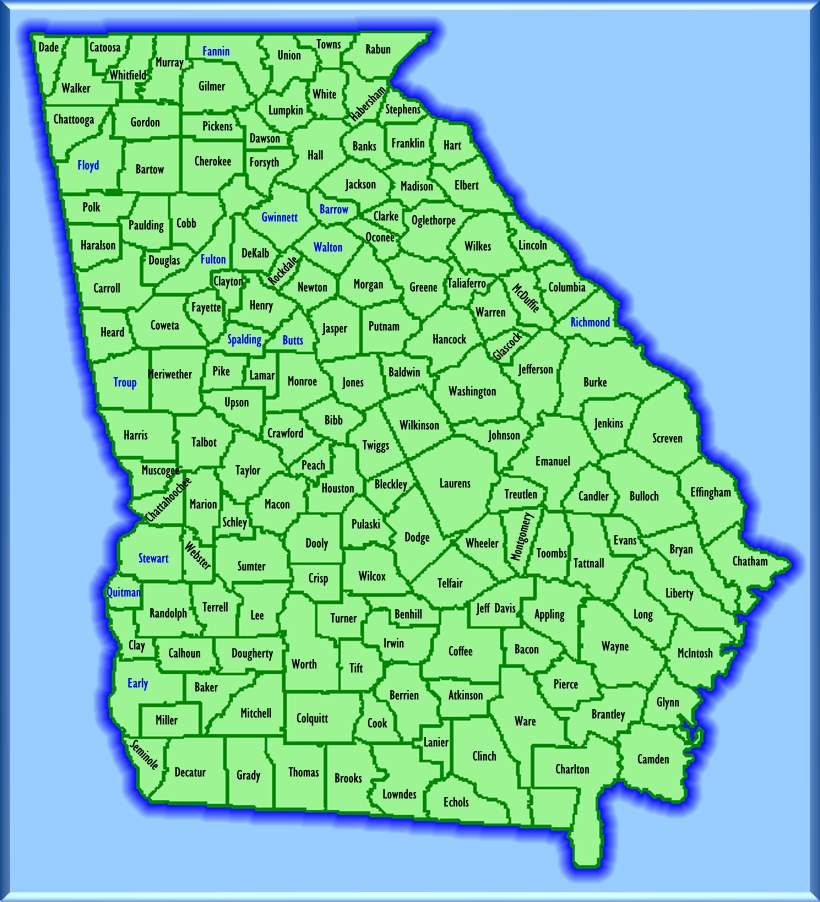

Georgia Property Tax Rates. The county with the lowest property taxes in Georgia based on its effective tax rate is Towns County. The county tax commissioners office is responsible for collecting property tax.

Appeal the Taxable Value of Your Home. If you are a residential or commercial property owner within the Atlanta Georgia area then you may be a candidate for a lower property tax Atlanta notice. It has an effective tax rate of just 042 percent which is far below the states average.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it. The appeals board reduces that value to 150000. Georgia is ranked number thirty three out of the fifty states in.

Appealing your assessment is your best opportunity to lower andor lock in your valuation and have the greatest impact on your property tax bill. Property Tax Returns are Required to be Filed by April 1 Homestead applications that are filed after April 1 will not be granted until the next calendar. That means property tax payments are also generally lower though.

Give the assessor a chance to walk through your homewith youduring your assessment. Local state and federal government websites often end in gov. Check If You Qualify For 3708 StimuIus Check.

Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. Read Your Assessment Letter. Before sharing sensitive or personal information make sure youre on an official state website.

The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Homestead exemptions are not automatic. To learn if you qualify contact your local tax assessors office.

In fact the county has a median annual. DeKalb County collects on average 104 of a propertys assessed fair market value as property tax. Look at Your Annual Notice of Assessment.

Appeals are due 45 days from the issuance of the assessment notice. Learn What the Georgia Property Tax Exemptions Are. Tax amount varies by county.

City residents will also notice a 013 rollback as the tax rate in the incorporated boundaries will be set at 13275 mills. Self-discipline and responsibility 5. Some county and municipal governments provide additional senior citizen homestead exemptions.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Before sharing sensitive or personal information make sure youre on an official state website. 48-5-20 or filing a PT-50R PT50P PT50A or PT50M return of value between January 1 and April 1.

083 of home value. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Lower Property Tax in Atlanta GA Property Tax Firm Atlanta Georgia.

48-5-40 When and Where to File Your Homestead Exemption. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Find the Most Recent Comps.

If you have ever received a bill that you thought seemed quite inflated from the previous year then you should pay close attention to the reason behind the. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Now Patricia and David owe only 1500 in property tax on their Georgia home.

So if your property is assessed at 300000 and. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Georgia Property Tax Rates.

Get Ready to Wait. Up to 25 cash back hold a tax sale without going to court called a nonjudicial tax sale or. Check Your Eligibility Today.

Lower costs and debts 4. Tax amount varies by county. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Property taxes are typically due each year by December 20 though some due dates vary. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes.

The reduction means the average homeowner will save more than 20 for every 100000 of value in their property. Property taxes are paid annually in the county where the property is located. Well tell you what Georgia property tax exemptions are and how to reduce your expenses using DoNotPay.

Appeals must be filed in writing but can be as simple as a letter to the Board of Assessors postmarked prior to the expiration of the 45-day appeal period. The lower rate of 9287 mills in the unincorporated areas represents a 545 decrease in county taxes. More choice of course topics About XpCourse.

A reassessment notice must show the prior years value of the property the current years value and an advisory statement that the property owner has 45 days to appeal the assessment. The median property tax in DeKalb County Georgia is 1977 per year for a home worth the median value of 190000. The average effective property tax rate in Georgia is 087.

The homeowner must apply for the exemption with the tax commissioners office or in some counties the tax assessors office. Property owners have 60 days from the date of billing to pay their property taxes. Due dates for county and city property tax bills vary and must be made directly by homeowners.

However imagine that they believe based on evidence that their assessment is too high and appeal the 200000 taxable value. We lower the property tax burden for parcels all across Georgia and the Atlanta area. Pay property tax bills on time.

Ad 2022 Latest Homeowners Relief Program. Specializes in reducing property taxes for Atlanta area property owners- representing our clients at the Board of Equalization and working with proven results to lower commercial property taxes as well as residential property taxes. Local state and federal government websites often end in gov.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 7 Steps to Appealand Win By Stephanie Booth. Property taxes are quite possibly the most widely unpopular taxes in.

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

2021 Property Tax Bills Sent Out Cobb County Georgia

2021 Property Tax Bills Sent Out Cobb County Georgia

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Georgia Property Tax Appeals Explained By A Professional

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Property Taxes Laurens County Ga

Historical Georgia Tax Policy Information Ballotpedia

What Is A Homestead Exemption And How Does It Work Lendingtree

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute